At the end of each year, it is important to ensure that any expiring benefits you have available to you are taken advantage of – that includes money set aside in your Flexible Spending Account (FSA). Dollars set aside in an FSA (either by yourself or your employer) are of the “use it or lose it” variety, so it’s important to check your balance and plan some appointments and purchases before the year ends.

Here are some important tips on managing your Flexible Spending Account:

Stay in touch with your employer about your FSA

Because an FSA can only be setup by an employer, and each employer has some flexibility in how they administer the account, you should say in touch with your HR department or person in charge of your benefits so you can be sure of the details.

“Use it or lose it” may not be entirely accurate

According to the IRS, employers have two options to alter their own FSA. They may extend a grace period into the next year for up to two and a half months, or they may offer the ability for up to $500 of your unused FSA dollars to roll into the next year. Offering one of these options is entirely up to the discretion of your employer though.

Adjust your contribution each year if necessary

What works for you one year, may not make sense the next. Treat your FSA as an important part of your family’s financial planning and make adjustments as necessary. If you are starting a family for instance, your medical costs could increase significantly, so you’ll want to make sure to contribute the maximum amount. The max in 2021 was $2,750 and in 2022 it will be $2,850.

Know what’s covered

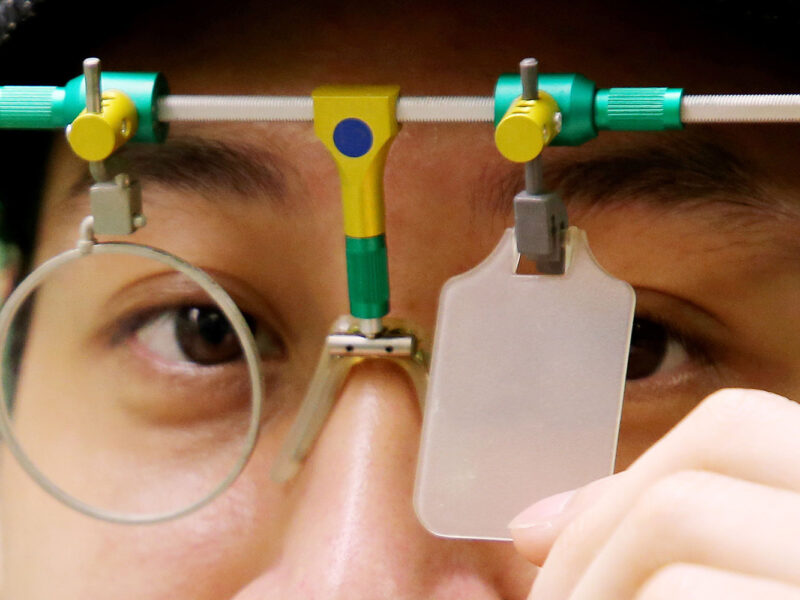

When it comes to taking care of your eyes, the majority of items you might purchase can be reimbursed through your FSA. This includes copays or any fees for your eye exam, as long they aren’t paid for separately through an insurance plan. It includes any type of prescription glasses, reading glasses or contacts. However, it also includes many of the accessories that you might not think would be covered. Things like contact solution, nose pads, cleaning cloths and more are all FSA eligible.

For the most up-to-date information on FSAs, visit the IRS’ website. Healthcare.gov has also put together a brief overview about FSAs that is easy to digest.